Anyone in the security industry knows that video surveillance is nothing new, with the first instance dating back to World War II, when it was used to view the launch of V2 rockets in Germany, before first being used in commercial applications in the U.S. in 1947.

Certainly, the technology has come a long way in the ensuing eight decades, but in some ways, it feels like it’s still in its infancy—and 2024 could be the year when video surveillance truly makes its mark, thanks to increasing use cases for artificial intelligence and cloud-based recording and management.

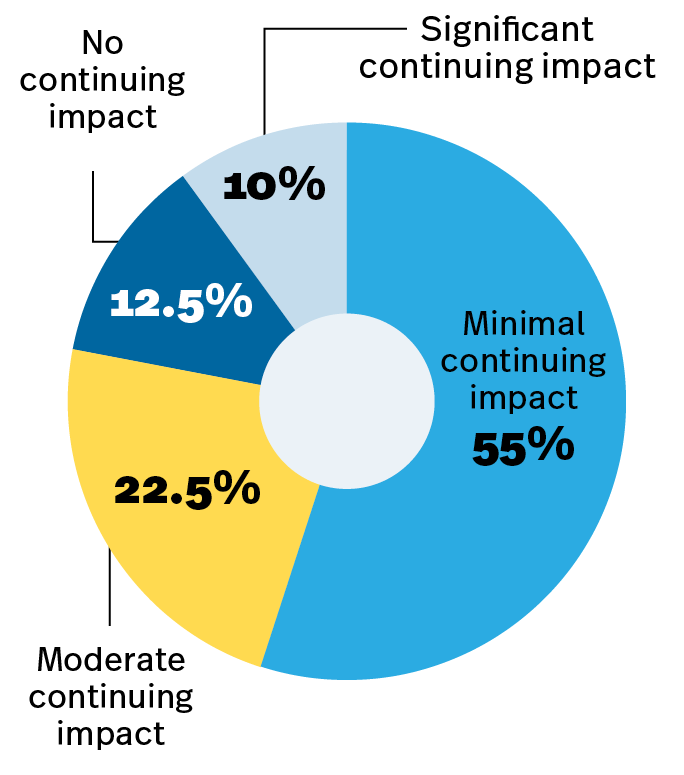

Our 2024 Video Surveillance Deep Dive shows that, while supply chain snafus and challenges related to finding and keeping talented people still remain in the physical security space, they are becoming less of an obstacle to completing installations, including those that feature video surveillance cameras.

We also learned that customers are becoming more familiar with what video surveillance is and does and asking for it by name when they talk to their favorite security integrators. And, while we’re likely to never get past the time when security installations are done when it’s too late, more end users are being proactive in protecting themselves with video surveillance systems, based on our research.

The Emergence of Video Surveillance

“If there’s a hot button that I think about 2024, that’s video surveillance,” says John Loud, president of 2023 SSI Installer of the Year LOUD Security Systems and chairman of the Electronic Security Association (ESA).

“We, as an industry, have watched over the 20-plus years about how video and cloud and storage and what people can see and does it allow audio or not allow audio and NDA compliance? There have been a lot of mitigating factors throughout the years,” says Loud.

Loud has always loved doing installations with an access control component, because it offers four pieces of recurring revenue, “but video surveillance is just going to absolutely dwarf the recurring revenue model that you see in the access control space today, even when people do manage the solution for their customers or do the maintenance and do the monitoring and do the cards.”

Video surveillance is becoming an emerging piece of the pie for 2021 and 2022 SSI Installer of the Year Acadian Total Security and Acadian Monitoring Services, a regional integrator based in southern Louisiana, says vice president Brandon Niles.

“Video surveillance and those pieces probably result in or make up about somewhere between 40% and 45% of everything that we sell,” he says. “On the recurring side of it, it’s not quite as large right now. We do sell a lot of monitoring services and that consists of probably about 10% to 15% of all of our RMR (recurring monthly revenue) is from the video surveillance side, not including service plans.”

“We do look at that to be a little bit different for the most part with service plans. We get that on about a little better than 50% of all the camera systems that we sell. We would love to see that higher and we’re actively working on that,” he says.

“With the monitoring side of our business, we are at this point almost 100% video monitoring-focused through our dealer partners,” says Niles, noting the company sold its alarm monitoring business a couple of years ago so it could focus on video monitoring.

“In that time, we’ve seen that part of our business grow by about 200%,” says Niles. “I’m not sure that we saw that level of increase in the five years that preceded those two years.”

Eric Yunag, vice president of global service-based systems integrator Convergint, which has almost 10,000 employees in 200 locations on five continents and serves primarily enterprise mission-critical environments calls video surveillance “a huge part of our business.”

“The knowledge and understanding of a lot of the current video ecosystem as well as a lot of the emerging trends around AI and cloud, those kind of things, are an important part of the capabilities that we bring to customers in the video surveillance space,” he says.

“There’s a high importance in that now is this velocity of changes is picking up with the move to AI and cloud and edge technologies,” says Yunag. “The collaboration between VMS (video management systems) and manufacturers is changing. That landscape is changing and what that means to put workloads of the edge and all that kind of thing.

“It’s just an encouragement to people to be really thinking critically about the technology partnerships that they have and how they’re fitting together and what technologies they’re investing in going forward so that these kind of outcomes and capabilities are there when they need them as they begin to emerge,” he says.

While effects of the supply snafu of previous years hasn’t completely subsided, it’s affecting the security industry much less significantly in 2024.

Finding the Right Solution for Your Customers

As customers have become more informed and sophisticated about technology, it’s become easier for integrators to have conversations with them that involve more complex—and pricy—video surveillance offerings, says Loud. But, he says, it’s not always about the bottom line. It’s about working together.

“There are many different providers that are doing the monitoring services for proactive video monitoring and the dialogue has gone from, ‘Mr. and Mrs. Customer, you called, you wanted a video surveillance solution. Let me talk to you about what this could look like.’ Now, you’ve got a proactive solution to offer,” he says.

“You’ve got notification, which is kind of an in-between price point, if you will, and then you’ve certainly got the surveillance solution that you asked for and when you sell the story about the solutions and say, ‘If we proactively do this, it’s like having a guard here all the time,’” says Loud.

Today’s video surveillance cameras are equipped with smart artificial intelligence (AI) capabilities that can tell users when something is blocking a camera or a camera has lost power, says Loud. That’s a major advantage for integrators, who can sell around-the-clock video surveillance and recording.

“We all know in the industry so very well that after somebody sustains another loss, they typically come back and start to buy a whole lot more twofold, fivefold, tenfold, even more,” says Loud. “You’re no longer going to meet a surveillance buyer and say, ‘Hey, I have an X-dollar opportunity for you.’”

“But now I’ve got three different price points and you’ll be amazed how people, just being aware of what you provide, even if they don’t buy today, they’re gonna certainly look down the road,” he says.

With the growth in the number of monitoring centers, “the cost for them to manage and monitor videos gets far more affordable in the next five to 10-plus years,” says Loud. “It’s no longer the race to the bottom of where cameras used to be hundreds of dollars. Now, it’s down to $25 or $30.”

The growth in video doorbells has made people more accepting of using and being observed by video surveillance cameras in just about all environments, says Loud.

“If you back up 20 years ago, we couldn’t even have audio and video put together because of wiretapping in many aspects,” he says. “There’s been lots of changes as well as cloud storage used to be so incredibly expensive and it’s now far more affordable today. And I would still project that five and 10 years from now, it’s probably gonna become more so affordable along the way.”

“I think you’re on the cusp of a time that, as you’ve heard the murmur about the video solutions and programs that have been available the last few years, now the dependability, the reliability, the accuracy because of the AI investments has been so tremendously different that you’re seeing many more folks getting into the space from the back-office side of it,” says Loud.

“When I started LOUD back in 1995, I used to put in my letters, ‘Take action 30 days too soon instead of one day too late,’” he says. “My encouragement to the integrator market is start to take that time to invest. This is not where we have to reinvent the wheel.”

He adds, “You’ll save yourself a lot of headaches and a lot of money if you do the research and reach out and work with some of the other integrators from other parts of the country. That will probably give you some roadmaps of dos and don’ts.”

2024: The Year Video Surveillance Explodes?

While video surveillance is certainly more commonplace and in more vertical markets than ever before, that doesn’t necessarily mean that 2024 will be the year it becomes ubiquitous.

“I wish the floodgates were gonna open tomorrow…but getting our sales team to get the success residentially and commercially, that’s where the cog is kind of stuck right now,” says Loud. “So while the cameras are ready, the AI is ready, the monitoring is ready, I think you’re still another year or two years away from even having really a massive scale of integrators jumping on board.”

“Some are just so afraid of those price points and some of the sales reps that are used to selling security systems for $50 or $60 or $30 couldn’t fathom thinking to sell a camera for $8,000 or $300 a month. I think we’re still a few years away where you’re gonna be able to get the consumer and the sales representatives,” he says.

Niles sees “opportunities around every corner, and it seems like they just keep popping up everywhere we look.”

“So, if I was going to look on that curve, I would say we’re definitely a good ways in,” he says. “A lot of clients are getting a lot more sophisticated with this and are aware of it, but there’s still probably 66, 70% of the market out there that we can start reaching out to there.”

“The market on what that camera system can do and how we can bring those new solutions, we’re just really just scratching the surface. I really think, in the next year, we’re gonna start to see a lot of companies pushing for video surveillance-only type of solutions,” he says.

Yunag expects to see the video surveillance market to continue to grow at historical rates, if not exceed them.

“I think that that continues to be a very robust area of growth and opportunity for the market,” he says. “The move to cloud analytics, edge analytics, all that kind of thing is really driving a large technology refresh cycle, in my view, of the next three, five, seven years.”

Yunag adds, “I think the parabolic or explosive growth that we’ll see will come from these emerging computer vision, non-security use cases. I think this is a significant area of opportunity for traditional systems integrators to begin to think outside of the box on how do you begin to communicate with other areas of customer organizations about visual intelligence as a business intelligence data asset?”

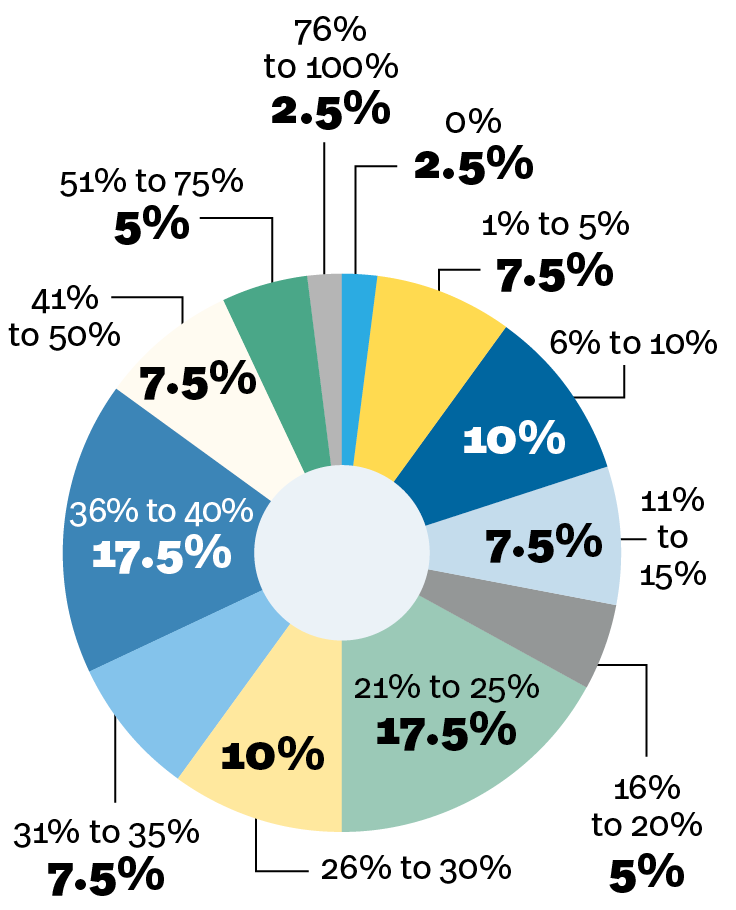

More than half of respondents put their gross profit margin between 21% and 40% for video surveillance installs.

Overcoming Pricing Concerns

Like any new technology, the newest video surveillance cameras come with a high price tag and that can lead some customers to wait it out and hope the price will eventually drop. While that’s not an uncommon approach, Loud says there are still ways to get customers to go for the top of the line.

“You’re leasing vehicles, you’re leasing copy machines, you’re leasing phone systems, you’re leasing everything,” he says. “So to actually not even, per se, call it a lease, but just a service plan that does include maintenance and everything for X dollars, it does lower the upfront barrier to enter.”

About two-thirds of the conversations Acadian has with customers on video surveillance are focused on price and the potential for the end user to get what they want for a more palatable price, says Niles.

“We know that a lot of our clients are price-conscious and we really don’t ever want to be the kind of company that sells based off of price point,” he says. “We want to be able to sell them and based off the level of service and solution we can provide, so we really start talking about the other solutions we can provide.”

“Sometimes we will give them a free monitoring services for a couple of months, just to try to seal the deal. Maybe we bring in a flexible payment plan to give them that flexibility because they can’t afford to pay for everything upfront. We’ve just tried to find different ways of bringing those as options to these clients and, most of the time, we’re able to find a way to get them into a surveillance system that works for their budget while also fitting their needs, and then still providing us some comfortable enough margin,” says Niles.

Yunag sees the video surveillance market divided into two sections: the more traditional cameras and service offerings and emerging threat detection technologies, including AI and visual intelligence collection.

“That’s when you start to see a wide variety of price points depending on outcomes or business use cases that are being enabled,” he says. “So I think that’s where customers are looking for advice and guidance on what technologies are real, what manufacturers have a thoughtful process for bringing these technologies forward, which ones are gonna be around in a few years.”

Yunag adds, “This is a rapidly changing environment, where startups won’t exist in a few years in a lot of cases, so helping customers navigate what that looks like [is important]. There’s a wide variety of ways to deploy and enable a lot of these new technologies and, with that, there’s a lot of different cost models to do it.”

Customers Getting More Savvy About Video Surveillance

While the stereotype is that most customers in the market for video surveillance and other physical security systems is that they are looking to protect themselves after they’ve been victimized, that pendulum may be swinging a bit.

“The last couple of years, we’ve seen a lot more people being proactive,” says Niles. “Crime’s on the rise in a lot of key markets for us and that’s really driving a lot of that, where they wanna get ahead some of the things they’re reading on the news and seeing elsewhere.”

He continues, “I do think there’s not a lot of conversation around operational analytics, but it’s definitely something that’s picking up speed: POS (point-of-sale) integrations, heat mapping, all the things that go along with that and so we’re starting to see a lot of people that like the operational abilities that gives them during the day, and then gives them that security comfort at night.”

Video analytics have developed to the point where they can help to identify or look for threats in the past five to 10 years, says Yunag.

“Customers are navigating that capability at a time of rapid technology change, and then the legal and compliance implications that come along with technologies that are theoretically or marketed to detect specific technologies, and that and that’s we have a lot of conversations about that with customers,” he says.

“It’s part of what we consider our role to be: to help inform and advise on the landscape of those technologies so that they can make good decisions on those investments that fit the risk profiles of their respective environments,” says Yunag.

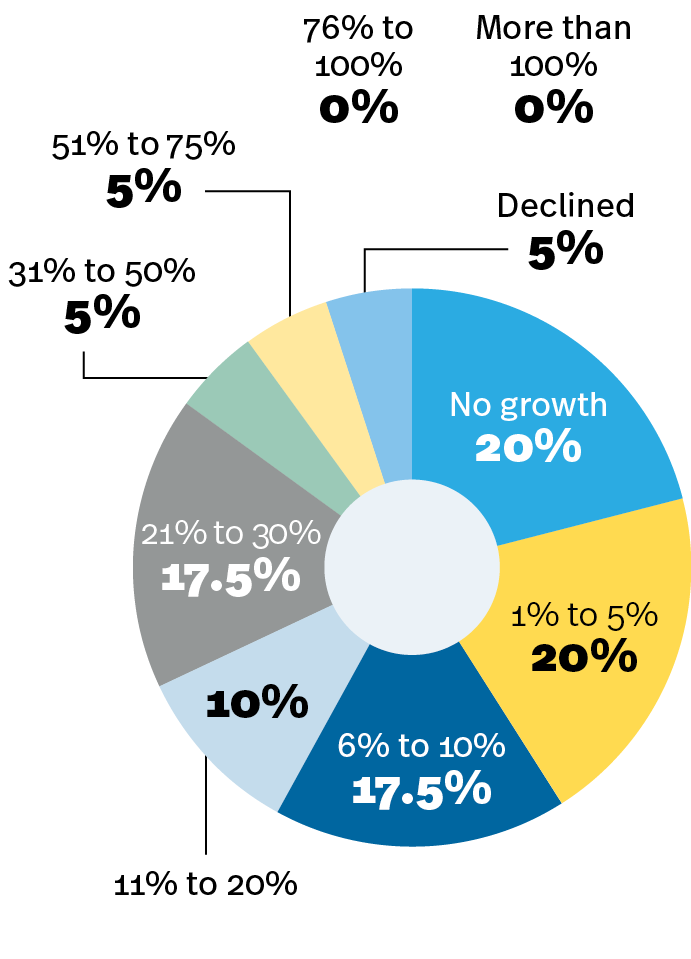

The past year has not shown bonanza growth for video surveillance. Nearly six in 10 respondents reported between 0% growth and 10% growth year over year.

Obstacles to Installing Video Surveillance

As concerns about the supply chain begin to wane, Niles points to customers’ IT departments as the top obstacle in completing their work of installing video surveillance systems.

“It’s really the cyber component working with IT departments, the different risk management teams, making sure if we’re putting it on their network, it’s not gonna create any vulnerabilities for them or pushing them towards the hosting route,” he says.

Acadian also often runs into issues of finding enough people who are able to install the systems they sell, says Niles, but it’s primarily clients’ IT staffers that create the bottleneck.

“I think, though, as the IT industry starts to collide with the security industry, especially in the surveillance market, we are starting to find other avenues to find the talent to get it installed,” he says. “Yeah, there’s somewhat of a threat there and that it can take over some of that business, but if you could find a way to work with them, it’s just as much of an opportunity as it is a threat.”

Niles continues, “We’ve had times where we felt like we were on the same page with them. We got them to sign off on it, and then we get midway through the process and somebody else in it gets brought in, they look and say, ‘Well, that’s not gonna work.’ You have to be flexible enough to pivot they bring in an alternate solution. It’s never fun but, when you’re dealing with larger clients, it happens from time to time.”

For Convergint, the most common obstacle or point of friction is centered on the legal and compliance aspect of a lot of the emerging technologies, says Yunag. That includes AI, data privacy, facial recognition and more, none of which come with any sort of federal regulations dictating how the information can and can’t be used.

“I’m not a huge fan, personally, of more regulation, but, when you have lack of clarity at a federal level on regulation in a lot of these areas, you have state-by-state guidance in some of these places and we find ourselves helping our customers navigate that a lot and that that involves lots of other uncommon stakeholders in our customer organizations: the legal department and compliance,” says Yunag.

Increasing RMR in Video Surveillance

Savvy integrators know that security integration is about a lot more than installing a suite of video cameras. Acadian has been “pushing heavily into video hosting, doing the cloud hosting route,” says Niles, and they’re seeing great success.

“It seems like bandwidth is getting cheaper than it’s ever been. It seems like these hosting solutions are getting more sophisticated than they’ve ever been as well and it’s just it’s opening up a lot of opportunities and it’s a really great RMR stream,” he says.

“We look at physical security as a service,” says Niles. “That’s a great way to take an equipment sale and bolt on some monitoring and turn that into an RMR as well. That model seems to be very successful, especially with clients needing some more flexible payment methods.”

Convergint thinks about “everything we do from a service perspective and ensuring the integrity of the systems that we deliver,” says Yunag.

“We always think about mission-critical deployments as having the need to have a consistent maintenance and service and cyber and all the other routines that go along with delivering those solutions,” he says. “Installing and configuring those things in the front end is a fraction of what needs to happen.”

Yunag adds, “If that solution is truly gonna deliver its mission inside of an organization to either limit risk or drive a compliance outcome or protect people and property, all those kind of things, and all of that subsequent management and monitoring and maintenance, those are conversations that we have upfront with all of our customers, because if they’re trying to achieve those type of things, someone needs to be performing those functions, and most of the time that comes back to us, or we’d like to think so.”

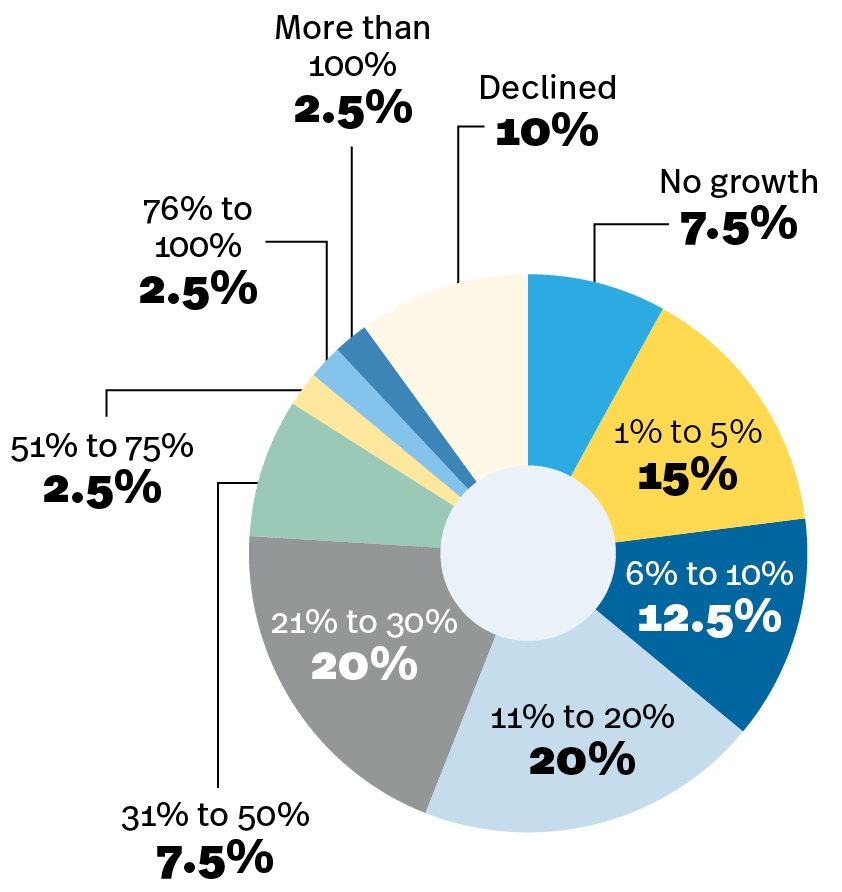

The five-year growth figures for video surveillance are more bullish. Nearly half of respondents reported growth between 11% and 50% over the past five years.

The Growth of Video Surveillance

While there are plenty of places where video surveillance seems to be a natural fit—from warehouses to corporate headquarters to retail locations—our experts say there have been a few installations in places they didn’t necessarily expect—and there could be more market applications in the future.

“The one that I didn’t think we would have had a great success is the high end residential,” says Loud. “People love to have choice, but with choice comes different price points. It may be that a resi solution doesn’t have 10 cameras. It may have two or three, but I think there’s been greater penetration there than I probably originally had thought, which is certainly encouraging.”

“There are so many verticals from even bicycle shops, schools galore, even mostly in the private sector, where you’ve got these churches that have daycare facilities that want to watch and see what’s going on,” he says. “Most folks have dumpster issues and they get fed up and frustrated enough that they want to all of a sudden say, ‘How do we stop filling the dumpsters?’”

Even as technology continues to play more of a role in the security market, nothing beats word of mouth when it comes to getting new work, says Loud.

“All these industries talk to each other, so once you get started within one, you know the referral factor [is huge],” he says. “When you talk about car dealerships, you talk about the cannabis vertical, low-income housing, when you start talking about those type of verticals, that’s pretty much been some of the heavy hitter verticals for video surveillance over the past decade.”

Acadian customers ask regularly about equipping their surveillance cameras systems with smart search and video and operational analytics, says Niles.

“It seems like customers are getting more sophisticated with that and requesting that just to make their lives easier after the fact,” he says. “I didn’t think that we would get that many requests from clients on that.”

Niles adds, “I kind of thought that was something we would have to bring to them but that is an area where they are coming to us a little more frequently in the past. That’s a little surprising, but definitely encouraging and a great thing to see.”

Yunag didn’t offer specifics but says Convergint sees “the desire to talk about using cameras for things that are well beyond what we would traditionally talk about in terms of video surveillance,” including operational efficiency, space utilization, occupancy, real estate management, process improvement, client satisfaction, marketing and analytics.

Those are areas where AI and computer vision really become important, he says.

“Organizations are really interested and coming to security because we have all the cameras or the security department inside of a customer organization has all these cameras and they’re beginning to say, ‘Well, what if we have all these cameras? How else can we leverage the visual intelligence that these sensors are producing?,’” he says.

“Chief information officers are thinking about ‘this is just the cameras, a sensor. It’s producing visual data now,’” says Yunag. “We’re entering a world where almost anything we can see, we can turn into data. So what do we want to see and what data do we want to understand about our environments?’”

Click here to dive even deeper into our 2024 research on video surveillance.

The post Video Surveillance Deep Dive: Technology Widening in Numbers, Vertical Markets appeared first on Security Sales & Integration.